Are you considering multiple different properties with different loan amounts & loan terms? If so, you can use this calculator to get a quick side-by-side view of how much your monthly loan payments will be for different loan durations & loan amounts. Change any input & this calculator will automatically update the totals. You can also generate a printer friendly version of the output report.

Quickly Compare & Contrast Just About Any Home Loan Scenario

This calculator can be used to quickly compare monthly payments and total interest costs for 10, 15, 20, 25 and 30 year mortgages, or to compare the payments on different homes or payments on the same home with different downpayment amounts.

We publish current El Monte mortgage rates in an interactive table which helps you to use real market data to perform your calculations and can connect you with a local lender.

By default this calculator allows you to calculate the impacts of insurance, real estate taxes & HOA fees. If you want to calculate the core principal & interest (P&I) payments without these other fees added in you can set the other inputs to zero. If the downpayment amount is 20% or more the PMI field will automatically be calculated as $0.

Mortgage Term Comparison Calculator

Current El Monte 30-YR Fixed Mortgage Rates

The following table highlights current El Monte mortgage rates. By default 30-year purchase loans are displayed. Clicking on the refinance button switches loans to refinance. Other loan adjustment options including price, down payment, home location, credit score, term & ARM options are available for selection in the filters area at the top of the table.

The Homebuyer’s Guide to Choosing the Right Mortgage

One of the biggest milestones in your life is buying your own home. A home symbolizes financial security and stability. It’s something most Americans look forward to with glee. But buying a home is no small task. There is a lot to consider before you even start shopping around for mortgages.

The type of mortgage you choose has profound consequences on your future finances. How much home can you afford? Where can you buy a home? All these and more hinge on the type of mortgage you can apply for. Before you shell out hard-earned savings, learn more about different home loans, terms, and how all these factors can impact your finances. How do you select the right mortgage? Let’s review your housing loan options.

Even getting to the point where buying a home makes sense is difficult. You must determine which mortgage option you can afford today and tomorrow. Explore your options with care before entering the market. Compare each option based on both your immediate and future needs. To compare terms and prices, use the above mortgage calculator.

The Terms of Repayment

Very few people can afford to pay for a home in cash. It will often take you a lifetime to earn and save that much money. What many people can do is pay off a mortgage. Little by little, you build up ownership (equity) over a property you bought with a loan. Depending on where you live, your monthly mortgage payments can be as cheap as or lower than rent!

But you don’t only pay the money you borrowed (your principal) when you take a mortgage. You also pay interest, the fee lenders charge for using their money. This can be a hefty amount, depending on the conditions of your mortgage. How much it would cost you will vary according to three factors. Besides your principal, you must also consider your rate and the length of your term.

In the U.S., the term of your mortgage refers to two things:

- Your amortization period, or the time it takes to pay off your mortgage. This is distinct from your rate of payment.

- The specific conditions outlined in your mortgage agreement for a period of years. These include your annual percentage rates (APR) and your monthly payment.

Some countries, such as the U.K. and Canada, make a distinction between the two. This is because the terms of payment do not last through the lifetime of a mortgage. Buyers must refinance their mortgage every once in a while to maintain their monthly payments. In the U.S., terms are often binding across the entire amortization period. In these cases, the two are synonymous.

A Matter of Time

Most mortgages in the U.S. have terms that last between 15 and 30 years. The 30-year fixed-rate mortgage offers the most attractive terms for many home buyers. They can expect a fixed monthly payment for three decades. But the stability comes at a price. The length of time influences both your monthly payments and interest costs. You end up paying more in interest even if you pay a lower monthly payment. You also take longer to build equity. Because of the way mortgages are set up, most of your payments go toward interest payments.

A 15-year term is a good alternative to the classic 30-year mortgage. They take less time to pay off and often have lower APRs. Taken together, these let you save thousands of dollars on interest payments. A 15-year mortgage also lets you build up equity faster. Because you pay less interest, more of your money goes toward paying off your principal. Moreover, you don’t stay in debt for as long!

The caveat is that you also pay a much higher amount each month. This prices out most first-time home buyers from 15-year mortgages. It also limits your choices of properties. You might not afford some places because their monthly payments are too high. But it’s a good option to consider if you can afford it.

For many, the higher interest costs of a 30-year mortgage is an acceptable trade-off. It is often the most inexpensive way to fit a mortgage into your budget. The lower payments also provide you with more financial flexibility. By paying less for your mortgage, you can focus on paying debts and growing investments. You can also afford to borrow more money to pay for bigger properties.

Improving Your Mortgage Offers

Choosing the right term is key to saving money on your mortgage. But how the types of mortgages can save you money varies. Because of the way they’re structured, mortgages cost more upfront. A mortgage that is cheaper in the long run may have higher monthly payments. Their requirements may also be impossible to qualify for if you’re still in a lower income bracket.

The key to maximizing your mortgage savings is to qualify for the best mortgage offers. Know what your loan options are and what they demand to qualify. Most mortgage lenders need proof that you can afford to pay back your loan.

One of the biggest challenges of the home market is that property values keep rising. Likewise, if you don’t qualify for the best mortgage option, you end up overpaying for your home. Choosing a mortgage option is a balancing act. You must give yourself ample time to improve your finances and qualify for the best loans. At the same time, you might need to move fast to buy the house at the best price.

Loan-to-Value Ratio

Your loan-to-value (LTV) ratio is an important consideration. At the start, this percentage measures the amount of money you must borrow to buy your home. Your LTV is the opposite of your home equity, or the amount of your home you own outright. To begin with, your home equity is the percentage of your home’s value covered by your down payment. Over time, your LTV ratio shrinks as you pay off more of your home, but this is a slow process.

Almost all mortgages need some form of down payment. The standard minimum down payment for most mortgages is 10 percent. In some cases, this can be much lower. And there are a few mortgage options that do not need down payments at all!

However, it is always better to pay a higher down payment whenever you can. The higher your down payment, the lower your starting LTV ratio. You borrow less money and pay less interest throughout your term. By increasing your down, you also own more of your home at the onset.

Private Mortgage Insurance

There’s another money-saving reason to aim for a higher down payment. Conventional lenders demand private mortgage insurance (PMI) for loans with down payments of less than 20 percent. Your PMI payment takes the form of an extra charge added to your monthly mortgage payments. It protects your lender from the likelihood of you defaulting on your mortgage.

Despite its name, PMI does not benefit you at all. You can cancel your PMI coverage once your LTV ratio reaches 80 percent. By law, PMI payments stop altogether when your LTV ratio reaches 78 percent. Depending on how much you’re paying, however, this could take a long time. That’s a lot of money that isn’t building you equity.

Credit Score

You can’t discuss anything about finance without bringing up your credit scores. These measure the likelihood of a borrower defaulting on a loan after 24 months of payments. Having an excellent credit score is essential to the mortgage application process. Before you go house hunting, take every measure to improve your credit score.

Credit scores are tied to revolving debt. Those with excellent credit scores have a reputation for making consistent debt repayments. They often pay off major debts or use credit cards often without incurring large balances. In contrast, people with abysmal credit scores struggle with debt and cannot take on any more.

The Problem of No Debt

One trouble with credit scores is that you need debt to have them. People who have lived debt-free all their lives are at a disadvantage. With no records of debt payments, they don’t have credit scores at all! This is a rude awakening to young adults who have sworn off credit for common expenses.

There is a way to maintain your debt-free streak while still building your credit. The trick is to pay off your credit card’s balance in full before the monthly deadline. By paying off your whole balance, you avoid incurring hefty interest charges. You can thus use credit cards for everyday expenses, but never pay interest. For this to work, you must have financial discipline. Never borrow what you can’t afford to pay off.

Several companies release credit scores used by lenders for comparison. Those released by the Fair Isaac Corporation (FICO) are among the most common. They are used by 90 percent of U.S. lenders. The FICO scores are classified as follows:

| Classification | Range | Percentage of U.S. Population | Impact |

|---|---|---|---|

| Exceptional | 800 – 850 | 21% | People with these scores receive the best available loan rates. |

| Very Good | 740 – 799 | 25% | Those with these scores get better than the average rates. |

| Good | 670 – 739 | 21% | These borrowers will have a high chance of getting approved. About 8% have a chance to be delinquent. |

| Fair | 580 – 669 | 17% | These are known as subprime borrowers. Lenders will give them higher rates than average to compensate for their risks. |

| Very Poor | 300 – 579 | 16% | People with these scores will not likely be approved for credit at all. |

If you have a FICO score of at least 670, you have a good chance of receiving a mortgage at a standard rate. One of the best ways to improve your credit score is by paying off your consumer debts. Paying off your car or your present credit card bills will reflect well on your mortgage.

You can receive a free credit report from AnnualCreditReport.com. Consumers are entitled to one free copy of their credit report every 12 months. Be sure to check it before applying for any loan. Companies like Credit Karma also report credit scores for free. According to Experian, you can do these four main steps to improve your credit score:

- Report inaccuracies in your credit report.

- Pay off existing credit card debt.

- Maintain a low balance on your credit cards.

- Pay credit bills on time to avoid credit score deductions.

TransUnion's VantageScore rating scale is as follows.

| VantageScore Classification | Range |

|---|---|

| Excellent | 750 - 850 |

| Good | 700 - 749 |

| Fair | 650 - 699 |

| Poor | 550 - 649 |

| Very Poor | 300 - 549 |

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio measures how much of your pre-tax income goes to your debts. For lenders, this is far more important a measure for creditworthiness and risk. Unlike your income and credit scores, your DTI ratio represents how much of your money goes where. Since 2020, new rules made the DTI ratio an important consideration for lenders. Though DTI ratio is not a full indicator of mortgage affordability, it’s still a crucial factor for mortgage qualifications.

A low DTI means that you have room in your budget for more financial commitments. Meanwhile, a high DTI ratio indicates that you dedicate much of your income to debt payments. In this state, you might not be able to afford another large monthly expense. Your likelihood of defaulting on your mortgage is high.

Your DTI ratio is divided into two parts:

- Front-End DTI represents the amount of your budget that goes toward your housing costs. This includes your rent or first mortgage, property taxes, homeowner’s insurance, etc.

- Back-End DTI is the money you set aside for all your other debt payments. These include not only your front-end DTI but also every other debt. Child support and alimony payments are also counted.

Most mortgage lenders demand borrowers meet a specific DTI ratio before getting approved:

| Mortgage Type | Maximum Front-end DTI | Maximum Back-end DTI |

|---|---|---|

| Conventional | 28% | Soft limit – 43% Hard limit – 45%-50% w/ compensating factors |

| Federal Housing Authority (FHA) | 31% | Soft limit – 43% Hard limit – 57% w/ compensating factors |

| Veterans Affairs* (VA) | Refers to back-end DTI | Soft limit – 41% Hard limit – 47% Lenders must explain why they approve above 41% |

| Department of Agriculture (USDA) | 29% | 41% |

The key to improving your DTI ratio is to pay off or clear your debts. By paying off your debts, you’ve accomplished several things at once. Not only did you reduce your DTI ratio, you also increased your cash flow and improved your credit score. Lowering your DTI ratio is also an excellent incentive for paying off specific debts (such as student loans) that don’t affect your credit score.

Fixed-Rate Mortgages

Choosing between a fixed rate mortgage or adjustable rate mortgage (ARM) is another crucial decision before taking out a loan.

Basically, if you opt for a fixed rate, your interest cannot be changed. If you choose an adjustable rate, the interest may rise or fall throughout the term depending on different economic factors. How do you know if a fixed rate or ARM mortgage will work for you? Assess your needs and decide if you're willing to take risks.

Essentially, your choice will boil down to these pros and cons:

| Loan Type | Fixed | Adjustable |

|---|---|---|

| Best suited for | people who want a stable payment over time people who intend to live in their home for many years people who can afford the full amortizing payment at market rates initially while still qualifying under DTI limits people who believe rates are likely to rise people who do not have other higher yielding assets they are comfortable investing in |

people who are flipping homes or otherwise intend to live in the home for a shorter duration of time people who need a lower upfront montly payment to reach DTI limits & plan to refinace in the future people who can handle market volatility people who believe rates are likely to fall people who have other higher-yielding investments they are earning returns on |

| Advantages | stable known payments for the life of the loan no matter if market conditions shift immediately begin to build significant equity no surprises or payment shocks from rates resetting |

typically charges a lower rate of interest initially lower upfront monthly payment |

| Disadvantages | higher upfront payment typically charges a higher upfront interest rate in exchange for stability |

monthly payments can reset at significantly higher levels as rates rise & the teaser rate period ends |

| Refinancing | if rates fall significantly you can still refinance at a lower rate in essence a fixed-rate is an option which locks in existing rates but still enables you to refinance at lower rates |

adjustable rate loans can be refinanced into fixed rate loans, or refinanced into adjustable rate loans when the teaser rate period ends some loans with below-market introductory rates may have prepayment penalties |

If you value need for certainty and prefer to adhere to a steady budget, a fixed rate will work for you. If you can take more risk, given there is a significant drop in market rates, you can take advantage of ARM. ARM's low initial payment allows you to prepay your mortgage—which might help manage the risk of paying expensive fees due to higher rates in the future.

For people who plan to stay put long-term, a fixed-rate mortgage is often the best choice. All fixed-rate mortgages in the U.S. have rates that stay the same through the life of your mortgage. Thus, your mortgage payments will never change, which makes it easy to fit in your budget. The stability it offers works well for many families who want to settle down.

And because they stay fixed on paper, it also puts inflation on your side. While your income keeps growing, your mortgage payment remains the same. But a fixed-rate mortgage has one key disadvantage. When rates go down, your present APR does not. You might end up paying a much higher monthly payment than you could have. The only way to change your APR into a lower rate is by refinancing.

Around 90% of all residential home loans across the United States are structured as fixed-rate loans.

Adjustable Rate Mortgages (ARM)

On the surface, ARMs seem attractive. But look closer and you might think that they’re a terrible deal. An ARM has a rate that floats according to an index. These are based on different benchmark indexes, such as the London Inter-bank Offer Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). The ARM’s rate is tied to this referenced index rate plus a few percentage points spread, which is called the margin.

Interest Rate = LIBOR benchmark + Spread

If LIBOR is 2.5% and Spread is 2.25%

Interest Rate = 2.5% + 2.25%

Interest Rate = 4.75%

In theory, your ARM’s rate will go as high or as low as the index rate allows. In practice there will be a cap to how much it can fluctuate. If your cap was 12 percent, for instance it will not go higher than that. But you can still expect the cap to be high. Take note of caps or limit adjustments to your loan. The limit can keep your rate from changing as much as the underlying benchmark. These caps can be placed in the first few years or the loan, as periodic or yearly caps, or as lifetime maximum limits.

For instance, if your loan has a 2 percent adjustment cap, but the market index increases by 3 percent, you can only experience up to 2 percent of that increase in your interest rate during an individual adjustment.

Most ARMs have an introductory period where the rates remain low. Some ARMs, known as hybrid mortgages, have a fixed-rate period that lasts for several years. Rates may stay the same for a year, five years, or even more. Beyond that, rates may go down and up, and may even change every year.

For example, the 5/1 ARM loan holds a fixed rate for the first five years, after which it adjusts every one year, or annually. That's what the 5 and the 1 stands for in the term.

3/1, 7/1 and 10/1 introductory terms are also common hybrid ARM loans. An adjustable rate loan which changes after the first year is considered a straight adjustable-rate loan whereas most borrowers take out hybrid loans with an extended introductory period.

Once the introductory fixed-rate term lapses, your interest rate starts to adjust. You have the option to refinance, either to a fixed-rate mortgage or another hybrid ARM. The key disadvantage (or advantage) of ARMs is their unpredictability. If the rates move higher, they will often cause a spike in your mortgage payments. This could lead to payment shock and leave your finances in disarray. But if interest rates drop, you could save a lot of money on mortgage payments.

An ARM is ideal for people who have high incomes and can expect changes in their monthly payments. They are also a cost-effective option for people who do not plan to stay in their homes long-term. People who buy and sell houses can also use ARMs to manage their costs. They can take advantage of the lower earlier payments to keep costs down while they fix the property.

Government-Insured Housing Loans

The government plays a major role in helping Americans purchase their own property. While they aren’t mortgage lenders, the government backs borrowers who get loans issued by private sector lenders. Having a government-insured mortgage means the lender is protected in case the homeowner fails to pay in the future. There are three types of government mortgage programs:

- Federal Housing Administration (FHA Loans)

- Department of Veterans Affairs (VA Loans)

- U.S. Department of Agriculture (USDA Loans)

Anything other than a government-backed loan is considered a conventional loan. This type of mortgage is ideal for homebuyers with good credit scores.

Conventional Mortgages

Most mortgages in the market today are conventional mortgages. This is a catch-all definition of mortgages backed by commercial entities like banks. These come with the best APRs in the market. Their strict requirements, however, make them difficult for entry-level workers to qualify for them. Conventional mortgages are ideal for more established people with excellent credit ratings. These are available in both fixed-rate and adjustable-rate variants. PMI is required if you pay less than 20% down payment. It is automatically canceled once your loan-to-value ratio reaches 78%.

- 15-year fixed mortgages typically charges slightly lower rates than 30-year fixed loans

- Borrowers with low down payments or low credit scores are charged a higher rate

- Jumbo loans above the conforming limit typically charge slightly higher rates

| Conventional Mortgages | |

|---|---|

| Best suited for | buyers with a high, stable income people with good credit scores |

| Down payment requirements | can be as low as 3% for 97-3 loans average down payment is around 10% putting 20% down alleviates PMI requirement |

| DTI limit | ideal borrower has front end of 28% or below & back end of 36% or below back end limit of 45% can be as high as 50% with compensating factors |

| Rates | both fixed & adjustable rate options are available 15-year fixed typically charges slightly lower rates than 30-year fixed loans borrowers with low down payments or low credit scores charged a higher rate jumbo loans above the conforming limit typically charge slightly higher rates |

| Expenses | average closing cost around $3,700 PMI can be canceled when the LTV reaches 80% and is automatically canceled when the LTV reaches 78% |

| Minimum credit score | 620 |

Conventional mortgages follow a conforming limit set by the Federal Housing Finance Agency (FHFA). These can be purchased, securitized, and guaranteed by the government corporations Fannie Mae and Freddie Mac. A specific class of mortgages called jumbo loans fall outside these limits. Thus, they cannot be backed by either company.

Jumbo loans are designed for buyers looking for luxury properties or properties in highly coveted areas of the country. Because of their size, they are governed under different underwriting rules. What defines a jumbo loan can vary at the state and county level. In expensive areas, the threshold for what counts as a jumbo loan can be quite high. As jumbo loans can not be backed by Fannie Mae or Freddie Mac the market is less liquid and these loans typically come with higher APRs.

FHA Loans

The Federal Housing Authority backs FHA loans which encourage lower-income Americans to enter the housing market. These are often cheaper in the beginning because their rates are often lower. Thus, they are an attractive option for entry-level home buyers.

Among government-insured loans, the most widely chosen by U.S. homebuyers is the FHA loan. FHA loans are popular because it's easy to qualify. They're suitable for people with credit scores down to 580, as well as buyers looking to pay a lower down payment.

One of the big drawbacks of FHA loans and other government mortgages are mortgage insurance premiums (MIPs). To qualify, you must pay an up-front MIP as a lump sum worth 1.75 percent of your principal. Later, you must pay MIPs each year, equal to a percentage of your principal. Unlike PMI, MIPs usually lasts through the life of your mortgage if you take a 30-year fixed rate FHA loan. Those who take 15-year fixed-rate FHA loans or make 10% down payment are charged MIP for 11 years. MIP can only be removed by refinancing to a conventional loan.

An FHA loan becomes more expensive as homeowners build equity. Thus, this is often considered a short-term option. Many FHA buyers refinance their mortgages later down the line. Once their credit scores improve, they can qualify for better terms available from commercial lenders.

- Typically cheaper in the beginning (particularly for those with poor credit scores) as rates are slightly lower

- More expensive further into the loan as the homeowner builds equity because of MIP

- Many FHA borrowers later refinance into a conventional loan to remove MIP

| FHA Home Loans | |

|---|---|

| Best suited for | homebuyers with low credit scores people who can afford small down payments |

| Down payment requirements | can be as low as 3.5% if your credit score is above 579 10% if your credit score is below 580 |

| DTI limit | 31% front end 43% back end back end can be as high as 50% with compensating factors |

| Rates | typically cheaper in the beginning (particularly for those with poor credit scores) as rates are slightly lower more expensive further into the loan as the homeowner builds equity as MIP requirement does not go away many FHA buyers later refinance into a conventional loan as their credit scores improve |

| Expenses | upfront mortgage insurance premium of 1.75% of the loan amount annual mortgage insurance premium of o.45% to 1.05% of the loan amount unlike a conventional loan, MIP requirement lasts for duration of loan |

| Minimum credit score | 580 scores as low as 500 can qualify given a 10% down payment |

You can only buy homes with an FHA mortgage to a specific price range. These are based on loan limits set by the Federal government.

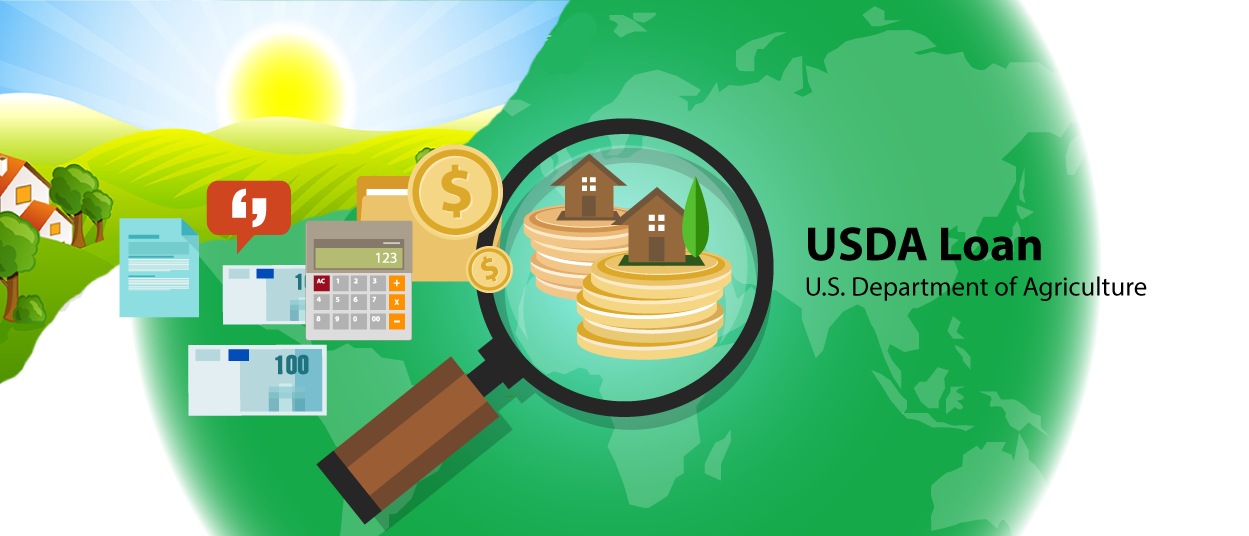

USDA Loans

Issued by the U.S. Department of Agriculture (USDA), these mortgages encourage buyers to settle in sparsely populated rural areas. Through this assistance, the USDA hopes to spur economic development throughout the countryside. The USDA Loan program has strict requirements for buyers, who must purchase land in designated areas. This is not as restrictive as it seems; many suburbs and small towns connected to metro areas are eligible for USDA loans.

The USDA loan is ideal for people looking for a home in the countryside. They are an excellent option for rural buyers. While these loans weren’t a ready choice for city-slickers, that could all change. Since the COVID-19 pandemic, more people began working from home. If the telecommuting trends continue, many buyers need not look for homes closer to where they work.

The USDA loan program offers many advantages to home buyers. They have some of the lowest APRs available in the country. The USDA loans’ up-front and annual MIP costs are also much lower than those from the FHA. They also have no down payment requirement.

| USDA Home Loans | |

|---|---|

| Best suited for | moderate income rural homebuyers ~ 97% of the United States land area is eligible |

| Down payment requirements | no downpayment required |

| DTI limit | 29% front end 41% back end |

| Rates | typically slightly lower than conventional mortgages due to federal government backing |

| Expenses | requires an upfront loan guarantee fee fo 1% requires annual mortgage insurance premium of 0.35% no prepayment penalty |

| Minimum credit score | 640 |

The USDA mortgage program requires buyers to choose a house in an eligible USDA area. It's a zero-down mortgage option that assists low to moderate-income borrowers with a minimum credit score of 640. If your credit score is below 640, you may still qualify, but you have to file for manual underwriting.

Interest rates in this loan type offers some of the lowest in the market. However, those with the highest credit score usually get the most competitive rates. Furthermore, it helps stimulate economic growth in relatively low population areas.

Other qualifications for a USDA loan include:

- A dependable source of income (2 consecutive years)

- No late payments 12 month prior to application

- Acceptable debt ratio (may vary according to lender)

VA Loans

The VA loan program provides low-interest, flexible mortgages for members of the U.S. military, including veterans, those in active duty, reserve members, and qualified widows. Unlike the FHA program, VA loans do not need a down payment or mortgage insurance premium (MIP) as the loans are backed by the U.S. Department of Veterans Affairs. Borrowers must pay a VA funding fee to offset the benefit’s cost to taxpayers. This fee, charged as a percentage of your loan, can be paid in two ways:

- The fee can be rolled into your VA loan.

- The fee can be paid upfront upon closing.

A buyer can qualify with a 620 credit score. VA entitles qualified members to 2 VA loans at once, or get another one even after a default.

These mortgages have lower APRs than most conventional loans and come with flexible repayment terms. The VA entitles qualified members to two loans at once, provided that they will sell the first VA-backed home upon taking a new loan. They may even borrow a second time if they default on their first loan.

| VA Home Loans | |

|---|---|

| Best suited for | military veterans active duty military active members of the National Guard & Reserves |

| Down payment requirements | no downpayment required borrowers refinancing a home via a cash out can extract up to 90% of their home equity |

| DTI limit | 41% back end soft limit can go higher with strong residual income |

| Rates | typically slightly lower than conventional loans due to government backing |

| Expenses | does not require PMI VA funding fee (varries, table shown below) |

| Minimum credit score | 620 |

The VA funding fee varies depending on several factors, such as how many times you’ve used your VA benefit, your down payment amount, and the type of VA loan you obtained. For detailed information on VA funding fee rates, visit the U.S Department of Veterans Affairs funding fee page.

| Type of Veteran | Down payment | Percentage for First time Use | Percentage for Subsequent Use |

|---|---|---|---|

| Regular Military | Below 5% | 2.15% | 3.3% * |

| Regular Military | 5% to 9.99% | 1.50% | 1.50% |

| Regular Military | 10% or more | 1.25% | 1.25% |

| Reserves / National Guard | Below 5% | 2.4% | 3.3% * |

| Reserves / National Guard | 5% to 9.99% | 1.75% | 1.75% |

| Reserves / National Guard | 10% or more | 1.5% | 1.5% |

| Either, for IRRRLs | any | 0.5% | 0.5% |

| Either, for manufactured homes not permanently affixed | any | 1.0% | 1.0% |

| Either, for loan assumption | any | 0.5% | 0.5% |

* The higher subsequent use fee does not apply if the only prior use of the Veteran's entitlement was for a loan on a manufactured home. Table source

Note, however, that VA loans do not guarantee the house will be free of defects. VA appraisals do not function as an inspection, so it's best to check the house yourself before buying it.

Veterans also have the ability to refinance their loans to lower the interest rate or convert an adjustable loan to a fixed-rate loan using the streamlined interest rate reduction refinancing loan (IRRRL) program.

Choosing the Right Loan Term

According to Freddie Mac, over 90 percent of home buyers chose a 30-year loan term. However, many of them might have saved if they chose a 15-year fixed rate. However, many of them might have saved better if they chose a 15-year fixed mortgages. In fact, throughout the life of a loan, a 30-year mortgage ends up costing more than double the interest compared to a 15-year option. But depending on your needs and income, there are instances where a 30-year loan can work better for you.

Consider these pros and cons before deciding on a 15 or 30-year fixed-rate mortgage.

| Loan Type | 30-Year | 15-Year |

|---|---|---|

| Best suited for | People who need the lower monthly payment to qualify under the DTI limits People who have other higher interest debts they want to pay off aggressively before focusing on their home People who have a diversified portfolio and believe they are likely to see higher returns investing in other asset classes People who are confident in their job stability | People who are comfortable with their monthly budget People who want to build equity & pay their home earlier People who are risk adverse People who view their home as their primary nest egg People who don’t have other higher yielding investments they would prefer to invest in |

| Advantages | Provides greater economic flexibility in the short run Allows the homeowner to pay off other higher interest debts Has a lower initial monthly payment Allows borrowers to qualify for a larger loan amount Allows them to afford a larger home, a home in a better neighborhood or closer to work | Typically charges a lower rate of interest Build equity faster Greater long-term economic flexibility |

| Disadvantages | Builds equity slower Keeps you in debt for a longer period of time Comes with a higher rate of interest Pay more interest over the life of the loan | Higher monthly payments May not be able to qualify for expensive homes due to the higher monthly payments Locks up more capital in the short run Giving less short term flexibility month to month for surprise expenses |

| Leveraging home equity | Equity is built much slower in a longer duration Homeowners can refinance their mortgage or take out a second mortgage to tap home equity | Equity is built much quicker in a shorter duration Homeowners can refinance their mortgage or take out a second mortgage to tap home equity |

Who should opt for a 30-Year Term? First-time buyers choose this loan term because it allows more affordable monthly payments and enables them to qualify for larger homes or homes in safer neighborhoods which may be closer to work. If you’re starting a family and still building your income, it would be practical to choose a 30-year mortgage.

Who should opt for a 15-Year term? If you can afford a higher payment, it would be beneficial to choose a shorter loan. This is ideal for people approaching retirement, when they will be dependent on a fixed income. Many people who refinance shorten their loan term to further reduce their interest rate and ensure their home is paid off sooner.

Pay Off Your Mortgage Faster

Anyone with a 30-year loan may feel like they're constantly in debt. Though it may seem far-fetched, it is possible to pay your housing loan earlier. To help sort out your mortgage fees, try this loan balance calculator.

Making additional payments early on in the loan term has the most impact because:

- It helps reduce the outstanding balance earlier

- A lower outstanding balance means less interest accrues

- You get more value from extra payments—mortgages are interest-heavy during the start of a term.

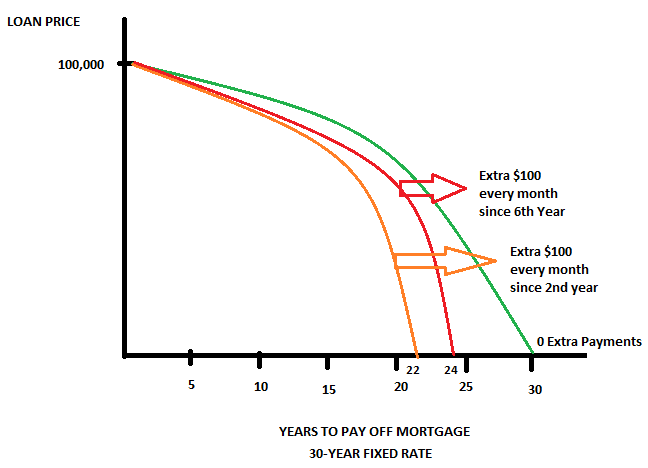

Let's take the example below for a 30-year loan. You'll notice how paying $100 extra as early as the 2nd year can remove years off your term.

Example 30 Year Fixed-Rate Mortgage

Details on above example loan:

- Loan amount: $100,000, Interest rate: 4%

- Paid Extra $100 Per Month = Started at 2nd year, Est. time removed = 8 Years

- Paid Extra $100 Per Month = Start at 6th year, Est. time removed = 6 Years

This shows that employing even a little effort to pay extra makes it possible to pay off your mortgage far sooner - saving thousands in interest expense. The key is to enforce the will power to manage your spending and prioritize your mortgage payments.

Practical Strategies to Pay Your Loan Faster

- Pay off high-interest credit card debt.

- Make extra payments to your mortgage principal each month.

- Make biweekly payments.

- Shorten payment terms.

- Make an extra payment each year.

- Refinance your mortgage when rates are lower.

Pay off high-interest credit card debt

Before you can pay off your mortgage, it's wiser to tackle credit card debt.

Credit cards have an average interest rate of 16 percent, which indicates paying off any credit card debt now will help you pay for your home a lot sooner. This frees up your cash flow and allows you to save.

Pay a little more on the loan principal each month

Go the extra mile and pay $100 or $200 more. Contact your lender and ask how they can help process monthly payments that exceed the regular amount. Over time, this additional payment can help reduce your mortgage interest and term.

Take note: Before making extra payments, make sure the lender does not charge any prepayment penalty. Also check your mortgage statements to confirm if extra payments to your principal were applied properly.

Make biweekly payments instead of monthly payments

This splits the monthly payment in half, paying it every two weeks. By the end of the year, you make 26 biweekly payments, which is equivalent to 13 monthly payments instead of just 12 payments in a year. With this strategy, you can remove at least 4 to 6 years off a 30-year term. For a 15-year mortgage, biweekly payments can shed off 1 to 3 years depending on the loan amount and interest.

How to make biweekly payments? Make sure to speak with your lender to arrange a biweekly plan. Some companies like AutoPayPlus require an enrollment fee for processing, while lenders like Wells Fargo let customers set biweekly payment plans for free.

Reconfigure payments to a shorter term (without refinancing)

While you're at it, consult with your lender to know various time frames for your monthly payment according to the current loan's interest rate. This way you'll know if it's possible to adjust it to a shorter term.

Even if they do not adjust the loan term in an official capacity you can still use the above calculator to figure out what you would need to pay each month to pay off your remaining balance in a specified amount of time. For example, you can use the 15-year monthly payment to pay off your 30-year mortgage in 15 years.

Ensure your lender does not offer prepayment penalties before making your final payment.

Budget for an extra payment each year

If you can't handle doing extra payments each month, you can add one more payment for a total of 13 payments for your principal annually. Try to make extra payments yearly and you may be able to reduce your term as much as 7 years. This is where your budgeting skills come in handy.

Common sources for extra payment include unnecessary expenses such as:

- Unused gym memberships

- Cable bundles

- Vices – Cigarettes, alcohol, etc.

- Other small purchases that add up

Moreover, you can get funding from your holiday bonus, tax refund, or inheritance payout to make lump sum payments.

Refinancing your mortgage when rates are lower

If you are not happy with the current stipulations of your mortgage, you can choose to refinance. This involves securing a new mortgage with different terms. This will pay off the balance of your old loan. You must then pay back your new mortgage. Refinancing allows you to change one or more aspects of your mortgage. You can change your APR, the length of your term, or both.

There are many reasons people refinance:

- They want to change the type of mortgage they repay. Those with government-backed mortgages, for instance, can switch to a conventional mortgage. Buyers who bought with an ARM can shift into a fixed-rate loan.

- They want to save on their mortgage payments. They can do this by lowering their rates, changing the length of their term, or both

- They want to obtain a lower rate and reduce the cost of their monthly payments.

- They want to cash out equity to fund other investments in business, pay off other high-interest debts, or fund other important areas of their lives.

To help you get started, you can use the above rate table to find the best mortgage rates in your area.

Refinancing is an expensive process. Because you are getting a new mortgage, you must pay the attendant closing costs, which is usually 3% to 6% of your loan. By refinancing, you often agree to increase your payments today so you can pay less tomorrow. Because of the costs, only consider refinancing if you plan to stay in your current home long-term. As a general rule of thumb a 2% drop in interest rates almost guarantees savings by refinancing. Though other lenders may say 1% savings is enough, it would be better if you can significantly lower the interest rate. This in turn helps lower your monthly payment.

If you time it right, you can save thousands of dollars on your mortgage payments by refinancing. The key is to get the lowest rate you can get. The ideal time to refinance is when rates go down by at least two percentage points lower than your current APR.

Refinancing into a conventional loan from FHA loan not only allows you to take advantage of declining interest rates, but would also allow you to remove mortgage insurance payments if you have 20 percent equity of your home.

Example: 30 Year Fixed-Rate Mortgage, Price: $250,000

Refinanced from a 30-year FHA loan to a 15-year conventional loan.

| Loan Type | Rate | Monthly P&I Payment | Average Monthly Interest | Total Interest |

|---|---|---|---|---|

| Original Mortgage | 7% | $1,663.26 | $968.81 | $348,772.25 |

| Refinance | 5% | $1,976.98 | $588.10 | $105,857.13 |

How it helps? Refinancing into a conventional loan from FHA loan not only would allow you to take advantage of declining interest rates, but would also allow you to remove mortgage insurance payments if you have 20 percent equity of your home.

While FHA loans are easier to qualify for, the mortgage insurance premium (MIP) can get very costly as time goes by. This annual premium ranging from 0.8% to 0.85% of the loan's value is required for the entire life of the loan and cannot be adjusted.

On the other hand, conventional loans generally offer lower mortgage insurance requirements, despite the higher credit score requirement. This makes it more favorable to refinance from FHA loan to a conventional loan.

The above example of refinancing into a loan with half the duration length would add around $310 to the monthly payments, however being able to remove MIP would save the borrower about $167 a month, so the net shift in monthly payments would only be $143 a month, yielding almost a quarter million dollars in interest expense savings.

While FHA loans are easier to qualify for, the mortgage insurance premium (MIP) can get very costly as time goes by. This annual premium usually costs 0.80% for the entire life of the loan. In contrast, you can eliminate mortgage insurance premiums once you refinance to a conventional loan. This makes it more favorable to take a conventional mortgage over the long term.

Extra Payments

To save money through refinancing, you must often accept a higher monthly payment. Not everyone can afford this, especially if your budget is tight. As an alternative, you can make extra payments on your mortgage. You can do this in two ways. One is to save up any extra money you have. Once you’ve earned enough, pay it toward your mortgage as a lump sum. The other way is to set aside a consistent extra monthly payment.

The main advantage of these payments is that they are non-committal. If you find yourself running short, you needn’t worry about it. You can still go back to your lower minimum payment then resume extra payments later. This also makes it easy to fit these extra payments into your budget. You decide how much you can pay.

Prepayment Penalties

The biggest advantage offered by fixed-rate mortgages is that your minimum payments do not lead to compound interest. As long as you make your monthly payments on time, you can clear off your mortgage in a few decades. They do come with one key drawback, however. Most conforming mortgages have prepayment penalties tied to them.

The prepayment penalty is put in place to prevent you from making extra payments to your principal too early. Most lenders make the majority of their profits from the first few years of a mortgage. Pay too much, too soon, and they may lose money.

In the past, these penalties can be punitive. Penalty clauses that last for five years were common Though rare, lifetime penalties were not unheard of. Since 2014, however, new regulations limited prepayment penalties only through the first three years of your mortgage. You may only need to wait three years to avoid the costs of prepayment penalties.

Moreover, prepayment penalties are still subject to restrictions. Only specific types of mortgages can have prepayment penalties. By law, government-backed mortgages, such as FHA, USDA, and VA loans, cannot have prepayment penalties. Most adjustable-rate mortgages and interest-only mortgages are also prohibited from having prepayment penalties.

In Summary

Be realistic with your goals. If you meet all the other qualifications but don’t have a good credit score, look at your other options. Your credit score might not allow you to get the best rates from a commercial lender today. But you might qualify for an FHA loan. This may be enough to put you on the path of home ownership. Don’t leave out every option available to you.

Remember to think ahead. Pay attention to changes in mortgage rates and your credit score. New opportunities may arise that can help you save money in the long run. If you’re lucky, you might save money by refinancing your mortgage to a lower APR. Future savings are important, but don’t make them your primary goal. After all, you can always refinance when you've improved your credit score and income.

To get the best mortgage options, you must be prepared to do your financial homework. Examine first the state of your finances and analyze your options. First off, make debt management your key goal. Divert your extra money toward making extra payments toward high-interest debts. Doing this accomplishes several objectives at once. Paying off debts improves your credit score and lowers your DTI ratio. It also frees up more of your money for savings.

While many factors will affect your decision, keep in mind that you want to purchase a house that's priced within your means. You also want to make sure it's accompanied with the most favorable terms. For the future, it's good to check for low interest rates in case you want to refinance your mortgage and obtain more affordable terms.

Once you've finally made your decision, make the commitment to pay your mortgage fees on time. If you make the effort to make extra payments early on, you can certainly pay off your housing loan sooner.

El Monte Borrowers: Are You Unsure Which Loans You'll Qualify For?

We have partnered with Mortgage Research Center to help El Monte homebuyers and refinancers find out what loan programs they are qualified for and connect them with El Monte lenders offering competitive interest rates.