This calculator will help you to determine the current remaining outstanding balance on your mortgage based on the number of payments you have made.

Enter the original loan amount, the APR along with the loan term in years.

Given historically low interest rates you may be able to save thousands by refinancing. We publish current El Monte mortgage rates.

Current El Monte 30-YR Fixed Mortgage Rates

The following table highlights current El Monte mortgage rates. By default 30-year purchase loans are displayed. Clicking on the refinance button switches loans to refinance. Other loan adjustment options including price, down payment, home location, credit score, term & ARM options are available for selection in the filters area at the top of the table.

Effective Strategies to Pay Your Mortgage Faster

Purchasing a home is a huge financial commitment. To afford a house, many buyers depend on home loans, which are typically paid for as long as 30 years. Most people tend to take 30-year fixed rate mortgages because they come with affordable monthly payments than shorter terms.

But wouldn’t it be great if you can pay your mortgage early? Doing so eliminates this major debt on your list before retirement. Plus, it will save you tens and thousands of dollars on interest costs. That’s money you can set aside for other important purposes, such as retirement funds or your child’s college tuition. It might seem like a longshot, but paying your home loan faster is possible. You’ll be surprised how giving a little extra payment every month can shed years off your term.

If you’ve been making mortgage payments for a few years, it’s important to know you current mortgage balance. Use the above calculator to find out your remaining loan amount.

Our article will discuss effective ways to pay your home loan sooner.

The Fundamentals of Making Extra Mortgage Payments

Making extra mortgage payments is the simplest thing you can do to pay your loan earlier. Even with a modest $50 or $100 each month, it can shorten your payment term by a few years. It will also increase your interest savings. You have the liberty to decide how much extra you can budget for your mortgage. It’s a viable financial strategy that shortens your term without having to refinance your loan.

Additional mortgage payments have the most impact when done early into the loan term. It reduces your balance earlier, which accrues less interest over the life of the loan.

To learn how extra payments work, you must understand how different components determine your monthly principal and interest payments. These include the following key variables:

1. Principal – the amount you borrowed, also shows your remaining balance

2. Interest rate – is based on the annual percentage rate (APR)

3. Loan term – the length of time it takes to pay your loan

When you borrow a large principal amount, expect to get high monthly payments. Likewise, reducing the principal will result in more affordable monthly payments on your loan.

As for the interest rate, a higher rate results in more expensive monthly payments. This yields costly interest charges over the life of the loan. Moreover, the size of your principal impacts your loan’s interest costs. The larger the principal you borrow, the higher interest accrues. Thus, reducing your principal is crucial if you want to save on interest charges.

For the loan term, you’ll notice that monthly payments become smaller when the term is longer. This is the reason why 30-year fixed mortgages are popular among consumers. Meanwhile, when you shorten the payment term, the monthly payment becomes higher. However, some consumers eventually refinance to shorten their term and obtain a better rate. When people refinance, they typically choose a 15-year fixed-rate loan.

Note that longer terms generate much higher interest charges. The longer you pay for a loan, the more interest accrues. Extended terms also come with higher rates than shorter terms. This is because borrowers have greater chances of defaulting on a loan with more time. To hedge against duration risk, lenders impose higher rates on longer terms.

Thus, choosing a shorter term will save you substantial interest costs over the life of a loan. You’ll also get to pay your loan sooner. But if you can’t afford a short term or refinance your mortgage, your next best move is to make extra mortgage payments toward your principal.

But before making additional payments, ask your lender about prepayment penalty rules. Paying your loan early is not profitable for lenders. To discourage early repayment, lenders usually require a prepayment penalty fee.

Watch Out for Prepayment Penalty

Prepayment penalty is a fee charged when you sell your home, refinance, or pay your mortgage before the agreed term. In particular, it’s required when you pay a significant percentage of your principal during the first years of the loan. Prepayment penalty usually lasts for the first three years of a mortgage, which costs around 1% to 2% of your loan amount.

Prepayment penalty can forfeit any savings you make from extra payments. Though small extra fees usually do not prompt penalty charges, it’s best to ask your loan servicer. To be safe, you can wait for the penalty period to end before making additional payments.

How much can you save when you make extra payments? To give you an idea, let’s take the following example. Suppose you bought a $325,000 home and made a 20% down worth $65,000. You took a 30-year fixed mortgage at 4.5% APR with a $260,000 loan. On the fourth year, you decided to make extra payments. Review the results below.

30-year Fixed Mortgage

Home Price: $325,000

Down Payment: $65,000

Initial Principal Amount: $260,000

Rate (APR): 4.5%

Principal Balance, 4th year: $246,829.92

| Mortgage | Original Payment | Extra $50 / month | Extra $100 / month | Extra $250 / month |

|---|---|---|---|---|

| Monthly payment (P&I) | $1,317.38 | $1,367.38 | $1,417.38 | $1,567.38 |

| Pay-off time | 30 years | 28 years 1 month | 26 years 7 months | 22 years 11 months |

| Time saved | None | 1 year 10 months | 3 years 5 months | 7 years 1 month |

| Total interest | $214,257.45 | $200,186.37 | $188,276.77 | $161,343.43 |

| Total interest savings | None | $14,071.08 | $25,980.68 | $52,914.02 |

*All calculations above and below do not include escrow costs.

Based on our calculations, if you pay an extra $50 per month starting on the fourth year of your mortgage, you’ll shorten your term by 1 year and 10 months. You’ll get to save $14,071.08 on interest costs. That’s a substantial amount that you can set aside for savings and other important expenses.

As the extra payments increase, notice how the term gets shorter. It also results in higher interest savings. If you pay an extra $100 per month, you’ll pay off your mortgage within 26 years and 7 months. This results in $25,980.68 worth of interest savings. Meanwhile, if you can budget $250 for extra payments, you can pay off your mortgage by 22 years and 11 months. This will save you $52,914.02 on total interest costs.

The example shows making a larger contribution will pay off your mortgage faster and yield higher interest savings. However, do not disregard small payments. If you’re short on your budget, putting little payments toward your principal has a significant impact in the long run. Even with $50, you’ll still save considerable interest on your mortgage.

Budget for a 13th Mortgage Payment Each Year

You can opt to make additional mortgage payments once a year. Ideally, this should be equivalent to a month’s worth of mortgage payment. In effect, you will have 13 payments a year instead of the regular 12 payments. Likewise, contributing a higher amount will pay your loan sooner and cut more years off your payment term.

You can time this extra 13th payment whenever you receive substantial income, such as a bonus from work or money you get from freelancing on the side. It’s also a good way to spend your annual tax refund. According to the IRS, the average federal tax refund by state ranged between $2,300 to $3,200 in 2019.

Using our first example, let’s presume you decided to make an extra 13th payment each year starting on the fourth year of your mortgage. Here’s how much money and time you can save.

30-year Fixed Mortgage

Principal Amount: $260,000

Rate (APR): 4.5%

| Mortgage | Original Payment | 13th Payment (starting on 4th year) |

|---|---|---|

| Extra mortgage payment | None | $1,317.38 (once a year) |

| Monthly P&I payment | $1,317.38 | $1,317.38 |

| Pay-off time | 30 years | 26 years 4 months |

| Time saved | None | 3 years 8 months |

| Total interest | $214,257.45 | $186,155.99 |

| Total interest savings | None | $28,101.46 |

According to the example, if you make a 13th payment each year starting on the fourth year of your mortgage, you can shorten your term by 3 years and 8 months. This means you can pay off your mortgage within 26 years and 4 months. You will also decrease your interest costs to $186,155.99, which saves you a total of $28,101.46.

Make a One-Time Lump Sum Payment

Now and then, you might stumble upon a large amount of funds. This can happen if a family member left you with cash inheritance. In other cases, perhaps you’ve earned a sizeable amount of profits from a lucrative business. While you’re keen on saving your money, consider putting a portion of it toward your mortgage. Paying a large amount instantly reduces your principal. This immediately eliminates future interest costs on your loan. And if you elect to make small extra payments throughout the term, you’ll surely pay off your mortgage earlier.

In this example, let’s presume you’re planning to make a lump sum payment worth $50,000 toward your mortgage. This payment is applied on the fourth year of your loan.

30-year Fixed Mortgage

Principal Amount: $260,000

Rate (APR): 4.5%

| Mortgage | Original Payment | With Lump Sum Payment |

|---|---|---|

| Extra mortgage payment | None | $50,000 |

| Monthly P&I payment | $1,317.38 | $1,317.38 |

| Pay-off time | 30 years | 21 years 4 months |

| Time saved | None | 8 years 8 months |

| Total interest | $214,257.45 | $127,034.16 |

| Total interest savings | None | $87,223.29 |

In this example, if you make a one-time lump sum payment of $50,000 on the fourth year of your mortgage, you’ll remove 8 years and 8 months off your current term. This means you’ll pay off your mortgage within 21 years and 4 months. Moreover, if you decide to make small extra payments, you can reduce you payment term below 20 years.

Take a Biweekly Payment Schedule

Another strategy you can do is to shift to biweekly payments. Most homeowners pay 12 payments a year based on the number of months. Biweekly payments, on the other hand, follow 52 weeks in a year. This allows you to pay half of the monthly amortization every two weeks. It results in 26 half payments, which is equivalent to 13 mortgage payments a year. You’ll save further by combining additional payments with your biweekly payments if you have extra funds.

Take note: A biweekly payment is paid every other week, not twice a month. Initially, it might look as if you’re paying the same amount, but this schedule lets you pay more by budgeting additional principal payments. Some months will have 3 payments, so be prepared for it.

On the downside, the shorter time in between can be challenging for certain people. Missing payments defeat the purpose of making additional contributions. You’ll also face penalty charges if you incur late payments on your loan. If you’re not comfortable with a tight payment schedule, it’s best to stick to a regular monthly payment.

The following example shows how making bi-weekly payments can affect your term and interest costs. This assumes you took a biweekly payment plan on the fourth year of your mortgage.

30-year Fixed Mortgage

Principal Amount: $260,000

Rate (APR): 4.5%

| Mortgage | Monthly Payment | Biweekly Payment | Biweekly + extra $100 |

|---|---|---|---|

| Periodic payment (P&I) | $1,317.38 | $658.69 | $758.69 |

| Pay-off time | 30 years | 24 years 11 months | 23 years 7 months |

| Time saved | None | 5 years 1 month | 6 years 5 months |

| Total interest | $214,257.45 | $186,661 | $151,474 |

| Total interest savings | None | $27,596.45 | $62,784.45 |

The example shows that taking a biweekly plan will shave 5 years and 1 month from your payment term. It will also reduce your interest costs to $186,661, which saves $27,596.45. Meanwhile, if you add $100 on top of your biweekly payments, you’ll remove 6 years and 5 months from your loan term. It will lower your interest charges to $151,474, which saves you a total of $62,784.45 on your mortgage.

How do you set it up? Get in touch with your lender to enroll in a biweekly payment plan. There are banks that setup automated payments every two weeks for your convenience. Others also allow you to make direct payments every two weeks online.

Beware of Payment Processing Scams

While banks arrange biweekly plans for free, some may require a setup fee, which can range from $200 to $500, and an additional fee for each transaction. These are usually provided by third-party processing services. Financial advisers generally caution against third-party payment companies for a simple system. The added costs will eat away your savings from biweekly payments. Moreover, some of these companies only make monthly payments on your behalf, which negates the purpose of biweekly payments. As much as possible, find a bank that will accommodate your request for free.

What if I can’t get a biweekly payment schedule? Sometimes your lender might not provide a biweekly payment plan. When this happens, there’s still a way to replicate term reduction by adding a particular amount to your monthly mortgage. Take your monthly mortgage payment and divide it by 12. The resulting amount is the extra payment you need to apply to your principal every month.

For example, your monthly payment is $1,317.38. When it’s divided by 12, it results in $109.79. This is the amount of extra payment you need to make each month, which adds up to $1,427.17. If you increase this amount, you’ll pay your mortgage sooner and boost your interest savings.

Saving Up for Extra Payments

Budgeting for additional payments is challenging if you don’t get your finances in order. It’s important to evaluate where you’re spending your money to cut down on unimportant expenses. Take online shopping for instance. Business Insider reported that m-ecommerce (mobile ecommerce) was projected to reach 45% of the total U.S. e-commerce market by the end of 2020. That’s approximately $284 billion from online mobile shopping alone. Unfortunately, some people are more susceptible to impulse-buying when they browse products on their smartphones.

To save up, steer clear of these unnecessary expenses:

- Cable bundles

- Inactive gym memberships

- Unused magazine or online subscriptions

- Dining out too often

- Excess sweets and snacks

- Vices – Cigarettes, alcohol, etc.

- Other items you buy on impulse (clothing, jewelry, gadgets, etc.)

Of course, you’re the only one who can tell yourself which expenses to give up and cut down. If you find that you’re spending too much on anything, such as food, clothes, or even a hobby, you know it’s time to exercise moderation. It’ll help you save money for important expenses such as your mortgage.

Tackle High-Interest Credit Card Debt First

It’s important to pay high-interest debt before focusing on mortgage payments. High-interest debts from credit cards can easily eat away your savings the longer you don’t pay them off. It curtails your cash flow and keeps you from making major life purchases. At worst, it can spiral into toxic debt that puts you at risk of bankruptcy.

In January 27, 2021, the average credit card rate was 16.11% APR, while the average rate for a 30-year fixed mortgage was only 2.87% APR. Moreover, interest on mortgages are tax deductible, while credit cards are not. Between both debt obligations, it’s wiser to prioritize high interest debt first. Once that’s paid off, you can free up your cash flow and focus on other more important expenses.

Refinance Your Mortgage When Market Rates Fall

Besides making extra payments, you can pay your mortgage sooner by refinancing your loan. Refinancing is a process that allows borrowers to pay off their existing mortgage with a new one. When you choose this option, the lender replaces your current mortgage with a new loan that has more favorable terms. Homeowners refinance to shorten their loan term, obtain a lower interest rate, or convert from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage (FRM). It’s an ideal financial strategy when market rates are generally low and if you plan to remain long-term in a home.

Since refinancing is basically taking a new loan, it comes with strict qualifications. To be eligible, you must have a credit score of at least 620. But to secure a competitive rate, your credit score should be 700 and above. Many lenders also prefer borrowers who have a loan-to-value ratio (LTV) of at least 80% and below.

- Refinancing does not come cheap. If you refinance within the prepayment penalty period, get ready for hefty penalty fees. Furthermore, closing costs for refinances range between 3% to 6% of your loan amount. If your remaining principal is $240,000, your closing costs can be around $7,200 to $14,400. This is a large sum, so prepare your budget before choosing this option.

- How low should rates fall? To justify the expensive cost, you must secure a significantly low rate, at least 1% to 2% lower than your current mortgage rate. Obtaining a lower rate will help you recoup the cost of refinancing faster.

- Refinancing from a 30-year FRM to a 15-year FRM: Generally, it’s beneficial to refinance into a shorter term if you have a good credit score. It’s also crucial to obtain a lower interest. Refinancing is ideal if you’re not near the end of your payment term (think 10 years or less). Finally, refinancing to a 15-year FRM results in higher payments. Make sure you can afford more expensive monthly payments before taking this option.

The National Consumer Law Center (NCLC) cautions consumers to avoid refinances unless you are certain you’ll save money with a new loan. The following chart details different factors you should consider before refinancing:

| Mortgage Refinancing | Considerations |

|---|---|

| Best suited for: | People with good credit scores who qualify for a lower interest rate People with many years remaining on their term People who can afford the expensive closing costs |

| Not suited for: | People who have been paying their mortgage for a long time People who plan to move in the next couple of years Mortgages with a prepayment penalty (wait for the penalty period to end) |

| Benefits: | Allows you to adjust the length of your loan term: – Increase the loan term to reduce your monthly payment – Decrease the loan term along with lower interest to pay it faster Allows change from an adjustable rate (ARM) to a fixed-rate (when interest rates are favorable) Allows you to cash out the equity you’ve built from your home – when you need cash for home improvements, child’s education, etc. |

| Disadvantages: | Is costly upfront, typically 3% to 6% of your outstanding principal – be prepared to for closing fees, appraisal, inspection, title search, etc. Home equity reduction if you choose a cash-out option – The resulting equity is the property’s market value minus the amount owed on your mortgage Refinancing from a 30-year FRM to a 15-year FRM entails higher monthly payments |

| Fixed Rate to ARM: | If rates significantly fall you can still refinance to a lower rate Locks in existing rates but still enables you to refinance at lower rates |

| ARM to Fixed Rate: | Can be refinanced into fixed rate loans, or into adjustable rate loans when the teaser rate period ends However, some loans with below-market introductory rates may have prepayment penalties |

Refinancing from an FHA Loan to a Conventional Loan

FHA loans are popular among low to moderate income homebuyers because they come with relaxed credit score standards and affordable down payment options. Borrowers can qualify with a credit score of 580 and give a down payment as low as 3.5%. The rates are also cheaper at the beginning of the term.

However, FHA loans get more costly the longer your pay your mortgage. This requires mortgage insurance premium (MIP), which is paid both as an upfront fee and an annual fee. The upfront MIP fee is 1.75% of the loan amount, while the annual MIP fee is typically around 0.85% of your loan . MIP for 30-year FHA loans is required for the entire life of the mortgage.

To eliminate the heavy cost of MIP, you can refinance from an FHA loan to a conventional loan. Lenders require a credit score of at least 620 and a loan-to-value ratio (LTV) of 80% and below to refinance from an FHA loan to a conventional mortgage.

After June 3, 2013, the FHA mortgage insurance can only be removed if a borrower refinances into a conventional loan. If your FHA loan originated before the said date, you are eligible to cancel MIP without refinancing. So think about this directive before refinance into a conventional mortgage.

If you got your 30-year FHA loan before June 3, 2013, you can remove MIP if:

- You have a good payment record, no late payments

- Your balance is 78% or lower than the last FHA appraised value

- You’ve paid your FHA loan for at least 5 years

The Importance of a Good Credit Score

Maintaining a credit score is crucial for securing loans at favorable rates and terms. Credit scores are used by lenders to evaluate creditworthiness, which is the ability to repay your mortgage. The higher your credit score, the lower your chances of defaulting on payments. This gives you greater chances of securing loan approval.

Before refinancing or taking any type of loan, review your credit report. You may order a free copy at AnnualCreditReport.com. Borrowers may request a free credit report every 12 months. You can improve your credit score by paying bills on time and settling large debts. Disputing errors on your credit report, such as a wrong billing address or unrecorded payment, can help increase your credit score.

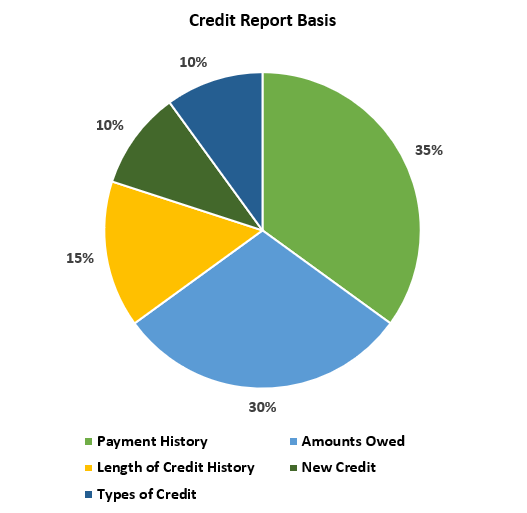

According to the National Credit Union Administration (NCUA), credit scores are determined by several factors on your credit report.

- Payment History – 35%

- Amounts Owed – 30%

- Length of Credit History – 15%

- New Credit – 10%

- Types of Credit – 10%

In assessing your payment history, credit bureaus consider the age of your accounts and how many of them have outstanding balance. They check if you’ve opened new accounts and if you normally pay on time. Generally, if you are close to maxing out your outstanding credit, you might have problems making payments in the future.

Credit score systems vary depending on the credit bureau reviewing your report. Common credit score systems in the U.S. are based on the Fair Isaac Corporation or FICO score and VantageScore.

What is considered a good credit score? A good FICO score falls between 670 – 739, while a good VantageScore ranges from 661 – 780. While both credit score systems range from 300 – 850, FICO scores are more commonly used by 90% of lenders in the U.S.

| FICO | Range | % of U.S. Population | Impact on Borrower |

|---|---|---|---|

| Exceptional | 800 – 850 | 21% | Obtains the best available loan rates. |

| Very Good | 740 – 799 | 25% | Gets better than average rates. |

| Good | 670 – 739 | 21% | Will likely to be approved for credit. 8% have the probability to be delinquent. |

| Fair | 580 – 669 | 17% | Subprime borrowers need to pay a higher rate to compensate for increased risk. |

| Very Poor | 300 – 579 | 16% | Not likely to be approved for credit. |

| VantageScore | Range | % of U.S. Population | Impact on Borrower |

|---|---|---|---|

| Excellent | 781 – 850 | 23% | Highly likely to get the best rates and favorable terms. |

| Good | 661 – 780 | 38% | Likely to be approved for credit at competitive rates. |

| Fair | 601 – 660 | 13% | May be approved for credit but not at competitive rates. |

| Poor | 500 – 600 | 21% | May be approved for credit but with unfavorable rates. |

| Vary Poor | 300 – 499 | 5% | Not likely to be approved for credit. |

FICO and VantageScore classification tables from Experian.

Comparing Rates Between Common Types of Mortgages

When it comes to homebuying, you’ll notice there are different types of mortgage products in the market. These loans come with varying interest rates and terms. Depending on your credit qualifications and budget, you can choose the right type of loan that suits your needs.

Popular home loans purchased by consumers are 30-year and 15-year fixed-rate mortgages. These are characterized by locked rates for the entire term. The fixed rate guarantees the same monthly principal and interest payments, so you don’t have to worry about payments increasing. 15-year fixed rate loans are also commonly used by borrowers when they refinance into a shorter term.

According to the Urban Institute, in October 2020, 30-year fixed mortgages comprised 74.2% of the new loans in the U.S. Meanwhile, 15-year fixed mortgages accounted for 16.9% of new loans in the housing market, which were mostly refinances. Lastly, adjustable-rate loans only accounted for 0.9% of the housing market in October 2020.

Adjustable-rate mortgages (ARM) come with rates that change periodically. Since most consumers prefer predictable payments, it’s not the most popular mortgage product in the market. ARMs are commonly taken as hybrid adjustable terms, such as 5/1, 7/1, and 10/1 ARMs.

For example, if you take a 5/1 ARM, the first five years of your loan comes with a fixed interest rate. After this introductory period, your rate is bound to reset once a year for the remaining term. ARMs are also available as straight adjustable terms where the rate changes right after the first year.

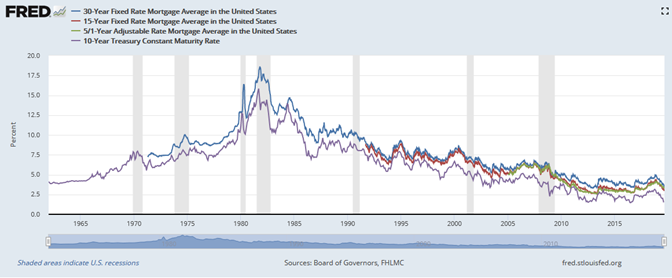

Mortgage rates generally change over time. Different mortgage terms also have their own projected interest rates. That’s why it’s important to compare rates between different loans and lenders. The following factors generally affects changes in market interest rates:

- The state of the economy

- Bond yield like the 10-year Treasury rate

- Lender and investor behavior for mortgage-backed securities

- Borrower loan attributes specific to the property

The chart below shows average rates for different loan types as of February 2, 2021. It also shows how rates have changed since January 21, 2021, from two weeks before.

| Mortgage Type | February 2, 2021 Rates | January 21, 2021 Rates |

|---|---|---|

| 30-year Fixed-rate | 3.15% | 2.88% |

| 30-year Fixed Jumbo | 2.99% | 2.92% |

| 15-year Fixed-rate | 2.66% | 2.36% |

| 15-year Fixed Jumbo | 2.41% | 2.92% |

| 5/1 ARM | 4.00% | 2.98% |

| 5/1 ARM Jumbo | 3.91% | |

| 30-year Fixed Refinance | 2.88% | 2.93% |

| 15-year Fixed Refinance | 2.38% | 2.41% |

| HELOC | 4.73% | |

| Home Equity Loan | 5.29% |

The following sections discuss key implications for different types of loans:

Length of Term

30-year fixed-rate loans typically have a higher APR than 15-year fixed-rate loans. This is around 0.25% to 0.50% higher. Lenders who offer extended terms take on more duration risk. Inflation also reduces the value of money over the years, making it a riskier investment. To hedge against duration risk, lenders require higher interest rates for 30-year fixed mortgages.

Fixed-rate Loans and ARMs

The chart above shows that the 30-year fixed rate is lower by around 0.85% than the 5/1 ARM. Currently, ARMs have a higher rate than fixed-rate mortgages. In 2020, market rates fell to record lows due to the COVID-19 crisis. The Federal Reserve announced it will keep benchmark interest rates close to zero to support market recovery. As a result, national rates on 30-year fixed rate loans have fallen below 3.3% in 2020.

However, during a rising interest-rate environment, ARM rates are usually at par with 15-year fixed mortgages or slightly lower. In a growing economic climate, fixed-rate mortgages would typically have higher rates compared to ARM introductory rates. For this reason, some borrowers would take ARMs to secure the low initial rate. This ensures they’ll have affordable monthly payments, at least during the first couple of years. But once the rate increases, borrowers must get ready to make higher payments.

The following chart shows factors you should consider before choosing a fixed-rate term or ARM:

| Loan Type | Fixed-rate Mortgage (FRM) | Adjustable-rate Mortgage (ARM) |

|---|---|---|

| Best suited for: | People who want stable payments for the entire loan People who intend to live in their home for many years People who can afford the monthly payments at market rates People who believe interest rates will rise People who don’t have higher yielding assets they are confident investing in | People who believe rates are likely to fall People who are can afford higher payments when rates rise People with higher-yielding investments with stable returns People who plan to live in the home for a shorter time People who need a lower upfront monthly payment to satisfy DTI limits & plan to refinance in the future People who are flipping homes |

| Not suited for: | People who believe interest rates will go down People who cannot afford a higher upfront payment | People who value the need for stable payments People who want long-term homes People who believe rates are likely to rise People who cannot afford higher monthly payments when rates rise |

| Benefits: | The same predictable payments for the entire loan regardless of market shifts Builds significant home equity right away No payments shocks or surprise payments from changing rates | In a rising interest rate environment, ARMs charge a lower rate than FRMs Affordable monthly payments during the introductory period |

| Disadvantages: | You end up paying more for interest compared to a shorter term You must qualify for refinancing if you want to obtain a lower rate | As rates rise and the teaser period ends, monthly payments can reset and increase significantly |

Conforming Conventional Loans & Jumbo Loans

- Conforming Conventional Loans: These are mortgages that fall within the loan limits required by the Federal Housing Finance Agency (FHFA). GSEs Fannie Mae and Freddie Mac strictly follow loan limits before approving mortgages. For instance, let’s say the baseline conforming limit in your area is $647,200. If your loan is equal or less than this amount, it will be secured as a conventional mortgage. Note that loan limits for high-cost areas are 50% higher than the baseline limit. For a list of updated loan limits, go to the official FHFA website.

- Non-conforming Conventional Loans: Also called jumbo mortgages, non-conforming conventional loans surpass loan limits assigned by the FHFA. Because these are more expensive loans, they cannot be secured by Fannie Mae and Freddie Mac. Jumbo loans are used to purchase expensive property in high-cost locations. They are suited for high-income borrowers with excellent credit scores and stable sources of income. Jumbo loans come with more thorough qualifying measures, so requirements are stricter than conventional loans.

Rates vary between conforming conventional mortgages and jumbo loans. In the past, jumbo mortgages have had higher interest rates than its conforming counterpart. However, between 2013 and 2018, jumbo mortgages shifted toward lower rates than conforming conventional loans. This is credited to positive economic conditions, when lenders would provide competitive jumbo rates to match conforming loans. Today, jumbo mortgage rates remain slightly lower than the 30-year fixed-rate.

During economic downturns, industry mechanisms that keep conforming mortgage markets liquid are not present for jumbo loans. Banks become cautious about lending huge sums, employing more strict credit reviews for borrowers. This results in a wider spread between conforming loans and jumbo loans.

To protect them from losses, jumbo lenders may impose further measures. In April 2020, during the onset of the COVID-19 crisis, Wells Fargo required restrictions on jumbo loan applications. During that time, they only refinanced jumbo mortgages if clients had at least $125,000 worth of liquid assets with the bank.

Wells Fargo eventually relaxed jumbo loan restrictions, at least for current clients. By July 2020, borrowers were allowed to refinance their mortgage as long as they had an existing loan with the bank and no other deposit accounts. Meanwhile, new clients were only allowed to refinance if they transferred at least $1 million to the bank.

Mortgages Refinances

Refinancing rates are generally lower compared to purchase loan rates. In February 2021, the 15-year fixed-rate refi is lower by 0.77% than the 30-year fixed rate purchase loan. Since rates have dropped to historic lows, many consumers have rushed to refinance their mortgage. In the first quarter of 2020, Attom Data Solutions reported that 1.07 million loan originations were refinances, which were over half of home loans in the market. That’s 1 in every 4 residential property units in the U.S.

HELOCs & Home Equity Loans

Generally, second mortgages such as home equity loans and HELOCs have higher interest rates than first lien loans. There’s greater risk for lenders when a borrower defaults on their first and second mortgage. When this happens, second lenders are only compensated after the first lender is paid. To offset this risk, second lenders usually require higher interest rates by 2% to 3% than first lien loans.

The Importance of the 10-year Treasury Rate

Apart from comparing current mortgage rates, keeping tabs on the 10-year Treasury rate should guide you when to purchase a home or refinance your mortgage.

The 10-year Treasury note is a loan you make to the U.S. federal government. It’s the only Treasury note that matures in 10 years, which is also backed by the guarantee of the U.S. government. For this reason, it’s a popular debt instrument which indicates wider investor confidence. Mortgage rates tend to follow whatever the 10-year treasury rate does.

How Does the 10-Year Treasury Rate Work?

The 10-year Treasury rate is the yield or rate of return on your investment. Treasury notes are sold at auction by the U.S. Department of the Treasury, with a fixed face value and interest rate. Through initial auctions or secondary markets, treasury products are sold to the highest bidder.

When the demand is high, investors bid higher than its fixed face value, making the yield low because it indicates lower return of investment. This low return is worth the risk because 10-year Treasury notes guarantee your investment is safe. Consequently, bidding higher for 10-year Treasury notes drive bank lending rates and interest rates to fall down.

When investors are looking to get more return on their investments, there is low demand for Treasury notes. They bid to pay less than its face value, which results in higher yield.

How does this affect your mortgage? The 10-year treasury note is a benchmark that guidesinterest rates, which applies to fixed-rate loans. For ARMs, the benchmark is based on the federal funds rate.

A rise in the 10-year Treasury yield means an increase in fixed interest rates for other bonds, which are deemed to have a higher credit risk. Investors purchasing bonds seek the best rate with the lowest default risk. If the rate on the Treasury note falls, rates in other investments can also follow suit.

By observing the 10-year Treasury rate, you may be able to know when it costs less to purchase a home, or when it’s ideal to refinance your mortgage. You can borrow the same amount of money with less interest. And when buying a home becomes less expensive, it can stimulate economic growth across the economy.

In Summary

There are many strategies you can take to shorten your term and boost mortgage savings. You can reduce your loan term by making extra monthly payments, taking a biweekly payment schedule, and budgeting for a 13th payment every year.

If you happen to have a large amount of money, you can also make a lump sum contribution to significantly reduce your loan’s principal. The higher extra payments you make, the sooner you can pay off your mortgage. If you have a good credit score, you can also refinance to shorter term. Just be ready to afford the hefty closing costs and higher monthly payments.

However, don’t forget to check the prepayment penalty fee. This typically lasts for the first three years of the mortgage. To steer clear of expensive fees, you can make extra payments or refinance after the penalty period has ended. Next, before focusing on mortgage payments, tackle high-interest debts first. The longer you leave credit card debts hanging, the larger your balance gets. This dampens your cash flow and keeps you from building savings. The sooner you eliminate high-interest debt, the faster you can get down to paying your mortgage.

Finally, it’s good to learn how interest rates change over time. Understanding how the market shifts can help you avoid unfavorable rates and obtain the best possible terms. With enough knowledge of market rates, you can time your home purchase or refinance when general market rates are low.

El Monte Borrowers: Are You Unsure Which Loans You'll Qualify For?

We have partnered with Mortgage Research Center to help El Monte homebuyers and refinancers find out what loan programs they are qualified for and connect them with El Monte lenders offering competitive interest rates.