Exploring the Uneven Housing "Recovery"

Why is the United States Homeownership Rate Stuck at 1965 Levels?

This infographic explains how the recent economic recovery has left a generation behind & how that has impacted that generation's faith in our economic system.

Share this Infographic

Share this Page on Social Websites

Embed this Graphic in Your Website

Full Width Version

800px Wide Narrow Version

Save PDF Version

Right click on this link to save the PDF version of this graphic.

Text Version of Infographic

“In the second quarter of this year, the [American homeownership] rate fell to 62.9 percent, not seasonally adjusted, which is the same as it was in 1965, when the U.S. Census started tracking the metric. During the epic housing boom in the mid-2000s, the rate soared as high as 69.2 percent.” ... "The drop in homeownership is largely due to a delay in homebuying by the millennials, who have the lowest ownership rate of their age group in history." - CNBC, based on the United States Census Housing Vacancies and Homeownership data series

graph source: FRED

A record number of Americans are living with their parents.

After the dot-com bubble burst the Federal Reserve's FOMC drastically lowered the Fed Funds rate from 6.5% to 1% & left interest rates low from 2001 to 2004. Low rates caused income-seeking investors to aggressively invest in alternatives to U.S. Treasuries which had higher relative yields.

Politicians promoted homeownership as the key to achieving "the American Dream."

President George W. Bush signed the American Dream Downpayment Act of 2003 on December 16, 2003 to promote homeownership.

This administration will constantly strive to promote an ownership society in America. We want more people owning their own home. It is in our national interest that more people own their own home. After all, if you own your own home, you have a vital stake in the future of our country. And this is a good time for the American homeowner. Today we received a report that showed that new home construction last month reached its highest level in nearly 20 years.

The reason that is so is because there is renewed confidence in our economy. Low interest rates help. They have made owning a home more affordable, for those who refinance and for those who buy a home for the first time. Rising home values have added more than $2.5 trillion to the assets of the American family since the start of 2001. The rate of homeownership in America now stands a record high of 68.4 percent. Yet there is room for improvement.

The rate of homeownership amongst minorities is below 50 percent. And that's not right, and this country needs to do something about it. We need to close the minority homeownership gap in America so more citizens have the satisfaction and mobility that comes from owning your own home, from owning a piece of the future of America.

Last year I set a goal to add 5.5 million new minority homeowners in America by the end of the decade. That is an attainable goal; that is an essential goal.

Low rates created demand for mortgage backed securities, which bond rating agencies stamped as investment grade even when they felt quality was suspect. An instant message exchange between Standard & Poor's employees captured the prevailing ethos:

Official #1: Btw (by the way) that deal is ridiculous.

Official #2: I know right...model def (definitely) does not capture half the risk.

Official #1: We should not be rating it.

Official #2: We rate every deal. It could be structured by cows and we would rate it.

The major credit rating agencies stamped AAA ratings on bad paper. They were key enablers:

“The three credit-rating agencies were key enablers of the financial meltdown. The mortgage-related securities at the heart of the crisis could not have been marketed and sold without their seal of approval.” - Financial Crisis Inquiry Commission

A tsunami of global capital poured into mortgage backed securities. Artificially low yields & investor demand for "low risk" investments with decent yields drove a housing bubble.

As the bubble continued, lending standards loosened. Subprime, Alt-A and even the term liars' loan became widespread as banks quickly securitized mortgages & sold them off to other investors along with GSEs Fannie Mae & Freddie Mac.

NINJA loans were the extreme version of liars' loans where lenders loaned money to people with no income, no jobs, and no assets. The following scene from Arrested Development captures what was happening in hot real estate markets.

Fannie Mae, Freddie Mac & AIG were bailed out after the housing market crashed.

The United States Treasury rejected overtures from sovereign wealth funds interested in investing in AIG. Conditions tied to the AIG bailout required them not to sue Goldman Sachs for fraud & to pay Goldman Sachs 100 cents on the Dollar on credit default swaps. These conditions created an ethics controversy:

the eventual form of the federal assistance, which unfolded in four separate transactions from September 2008 to March 2009 in response to changing conditions at the company and in the capital markets, appears more problematic because AIG’s counterparties in the credit insurance business—mainly large domestic and foreign banks—received what now looks to be very generous treatment from the government during the bailout. This treatment has been seized upon by bailout critics who passionately argue that government officials with long histories and deep connections in the finance industry promoted this generous treatment, and that such treatment is a perfect example of corrupt “crony capitalism” at work.

The Treasury's 'point man' on AIG, Don Jester, was a former Goldman Sachs CFO & held stock in the company while making bailout decisions.

While employed by CitiMortgage as the senior vice president and business chief underwriter Richard Bowden found that over 60% of mortgages purchased and sold to Fannie Mae & Freddie Mac were defective:

In mid-2006 I discovered that over 60% of these mortgages purchased and sold were defective. Because Citi had given reps and warrants to the investors that the mortgages were not defective, the investors could force Citi to repurchase many billions of dollars of these defective assets. This situation represented a large potential risk to the shareholders of Citigroup."I started issuing warnings in June of 2006 and attempted to get management to address these critical risk issues. These warnings continued through 2007 and went to all levels of the Consumer Lending Group.

"We continued to purchase and sell to investors even larger volumes of mortgages through 2007. And defective mortgages increased during 2007 to over 80% of production."

Before President Obama won the 2008 election Citigroup executive Michael Froman emailed John Podesta recommendations for staffing the incoming presidential administration. Citigroup was the largest recipient of TARP funds, receiving a total of $476.2 billion in cash & guarantees. Even after being bailed out Citigroup continued defrauding the Federal Housing Administration.

“My administration is the only thing between you and the pitchforks.” - President Obama

To this day, some people blame the housing crisis on the Community Reinvestment Act from 1977, however the CRA did not force banks to make bad loans. The foreclosure crisis was most prevalent in Arizona, California, Florida & Nevada versus urban areas like Chicago, Baltimore or Philadelphia where poor minorities made up the bulk of the population. Further, most subprime lenders were not covered by the CRA:

A Register analysis of more than 12 million subprime mortgages worth nearly $2 trillion shows that most of the lenders who made risky subprime loans were exempt from the Community Reinvestment Act. And many of the lenders covered by the law that did make subprime loans came late to that market – after smaller, unregulated players showed there was money to be made.

A foreclosure crisis followed the housing bubble crash. Bank representatives fraudulently "robo-signed" thousands of court documents. Homeownership rates fell as foreclosures rose. Suicide rates jumped with foreclosures.

David Dayen's Chain of Title is an authoritative book showcasing how widespread the foreclosure fraud was.

Central banks expanded their balance sheets to $19.4 trillion to reflate the global economy.

As central banks increased the size of their balance sheets financial asset prices rose.

As home prices bottomed hedge funds & private equity investors raised & spent billions buying hundreds of thousands of homes:

"Since 2010, institutional investors backed by Wall Street have purchased a total of 528,369 single-family homes nationwide, led by Florida (78,155), California (52,802), Georgia (46,914), Arizona (35,979), and North Carolina (34,769), according to RealtyTrac. These represent about 4 percent of all single-family homes sold during that period, and a higher percentage in distressed markets. Together, these Wall Street entities have raised close to $70 billion to buy these homes." ... “In Atlanta, Blackstone purchased 1,400 homes on a single day in April of 2013.” - American Prospect, September 29, 2015

Private equity firms & hedge funds continue purchasing homes in 2017, 2018 and 2019. They began crowding out both individual investors & homeowners, buying a record share of the housing market.

As investors bought the housing stock they raised rents, leading U.S. renters to pay higher rents each year, reaching $504.4 billion in rent in 2018.

Key cities where jobs are plentiful have seen faster increases in rent prices. Many online apartment listing sites show a median rent of between $3,600 and $3,700 for one bedroom apartments in San Francisco.

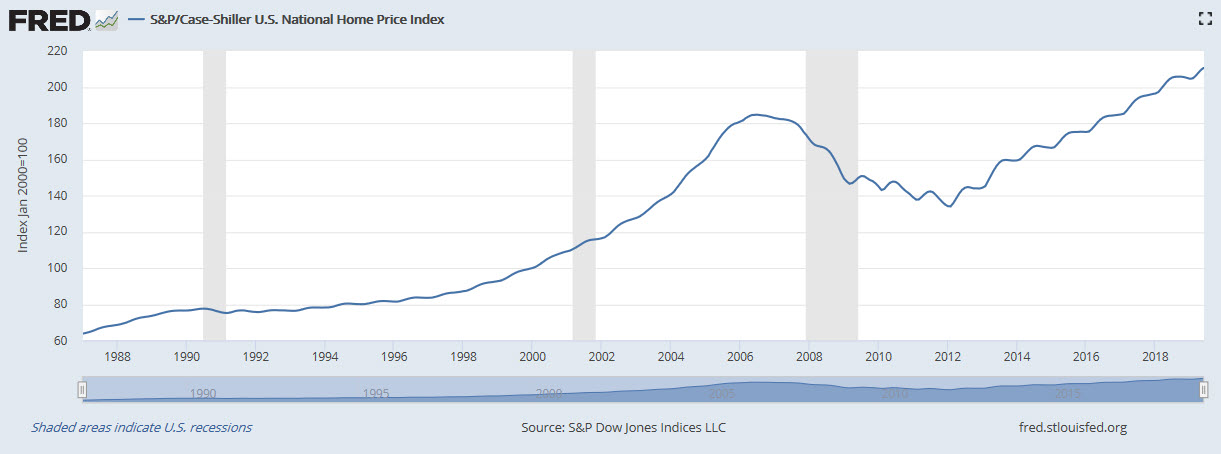

graph source: FRED

Nominal property prices now exceed the prior bubble peak according to the Case-Shiller National Home Price Index.

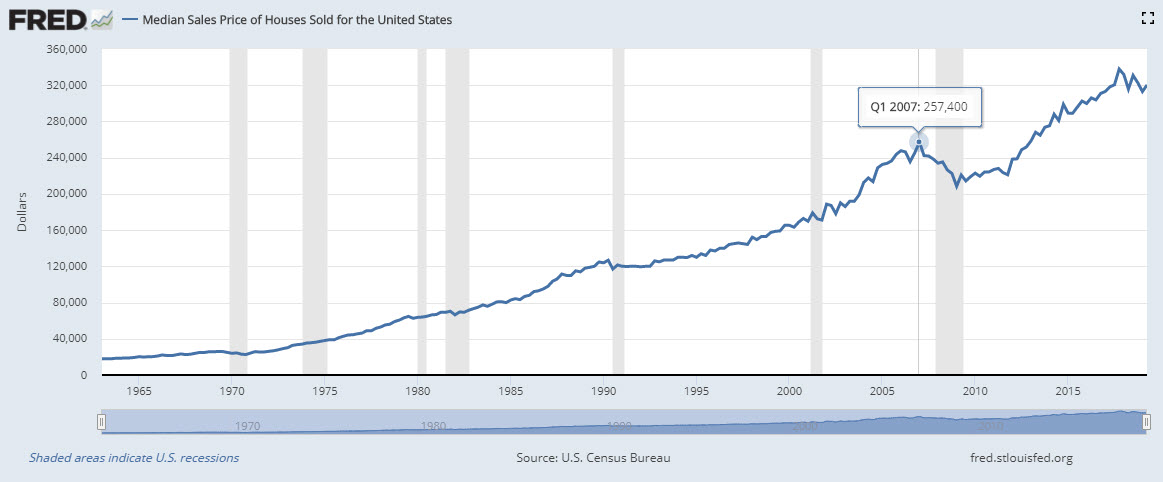

chart source: FRED

The median home sales price was $257,400 in 2007 Q1 at the prior bubble peak & was $320,300 in 2019 Q2.

chart source: FRED

In spite of rising property prices, even some of the most expensive domestic markets looked relatively cheap to foreign investors from Shenzen & Hong Kong, where properties recently sold for $726 & $2,091 per square foot. Foreign investors purchased over $100 billion in real estate per year & only recently started to pull back:

Foreign purchases of U.S. homes have dropped by half over the last two years, a fresh blow to the top end of the market in New York City, Miami and cities in California. Foreigners bought less than $78 billion worth of U.S. residential real estate in the year that ended in March—a 36% decline from $121 billion the previous year, according to a report released Wednesday by the National Association of Realtors. ... Both nonresident foreign buyers and immigrants cut back on U.S. home purchases in the year that ended in March. The largest drop was in buyers from China, who purchased just over $13 billion worth of U.S. homes during that time period, a 56% decline from the prior 12 months. Chinese buyers had been especially active in California. Mr. Yun said the pullback may be beneficial if it helps alleviate a housing shortage. But in places like New York and Miami, where there is a glut of luxury condos, it is less welcome.

Foreign investors were buying 266,800 homes per year. In recent years developers have shifted toward building higher margin higher end properties, leaving limited inventory at the entry level end of the market. This lack of supply caused lower priced homes to appreciate faster:

developers focus on high-end properties where profit margins are higher. The average price of lower-priced homes rose by 64% from early 2012 to late 2018, according to mortgage-data tracker CoreLogic, while the price of higher-end homes rose just 40%."

Since the March 2011 nadir in real estate prices, homes which were priced 25% below local median prices appreciated twice as rapidly as homes priced 25% above the local median price:

Two factors have added to the demand and supply imbalance for lower-priced homes. One is that investors are a much larger share of buyers than had been the case. (Figure 2) During 1999 to 2003, investors were 10.7% of the buyers of entry-level homes, but this had risen to 19.2% in 2015 to 2019. A second reason is the dearth of new construction of lower-priced homes. In 1999 to 2003, 3.8% of entry-level sales were new construction, but by 2015 to 2019 this had fallen to only 1.8%.

Like rents, property prices are appreciating faster in mega city metro regions where jobs are plentiful. In San Francisco the median single family home listed for $1.7 million & the median condo was listed at $1.3 million. Home prices are expected to rise further due to the ongoing wave of tech IPOs:

Deniz Kahramaner, a luxury real-estate agent at Compass, estimates that there will be 4,600 tech workers poised to make all-cash offers for homes in the $1 million to $5 million range after companies including Airbnb and Uber go public. But not all will be able to purchase homes because of limited supply. For instance, the in-demand neighborhood of Noe Valley currently only has about 12 single-family home listings.

As property prices rise those who missed out on the IPO lottery are struggling to save up for a down payment. If a person saved 5% of the median local income each month to apply toward a 20% down payment they would need to save for 36 years in New York City, 40 years in San Francisco & 43 years in Los Angeles.

Young people who reached working age after the recession tried to improve their prospects by investing in education.

- Student debt recently reached $1.53 trillion, growing over $100 billion per year since the Great Recession.

- After accounting for inflation, the cost of college tuition, room & board has more than doubled since 1971

- 44.7 million Americans (over 1 in 4 adults) have active student loans

- In 2018 2 in 10 students were behind on their debt payments

- The average 2017 college graduate who borrowed to pay for their education graduated with $28,650 in debt.

If a student were to repay $28,650 in 10 years at 6.8% interest, the monthly payments would be $321.

Graduating during a recession leads to around a 9% loss of earnings. Five years after a recession, people who have their jobs displaced during recession earn about 16% less than those who did not:

five years later, displaced workers who had reentered the workforce still earned 16 percent less than comparable workers who had not been displaced.

About 45 percent of these long-term earnings losses resulted from reduced work hours, and about 55 percent from lower hourly wages. The majority of displaced workers came from three industries: manufacturing, trade, and professional services like real estate, finance, and management.

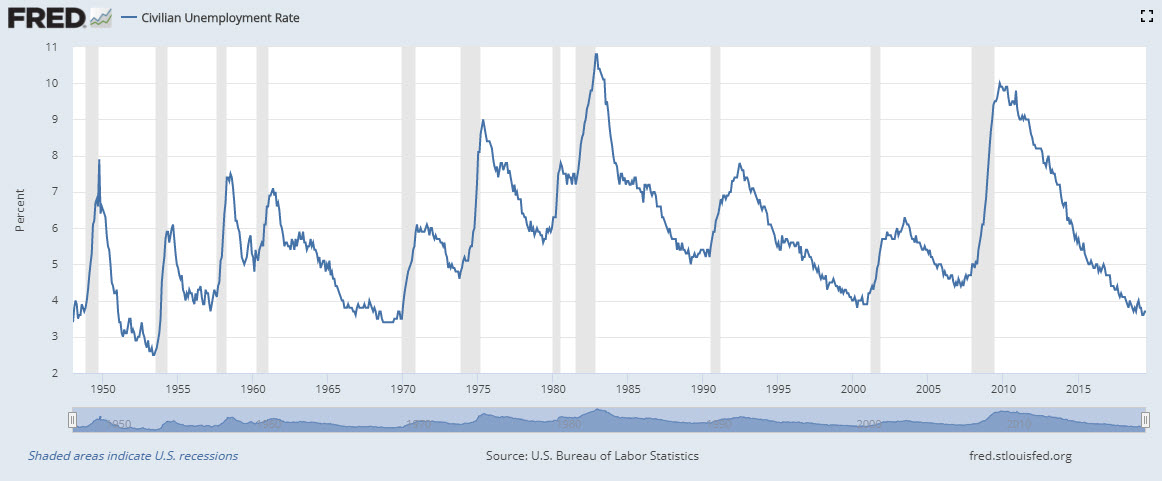

The unemployment rate has fallen to a record low of 3.7% from a high of 10% in October. 2009

chart source: FRED based on BLS Employment Situation data

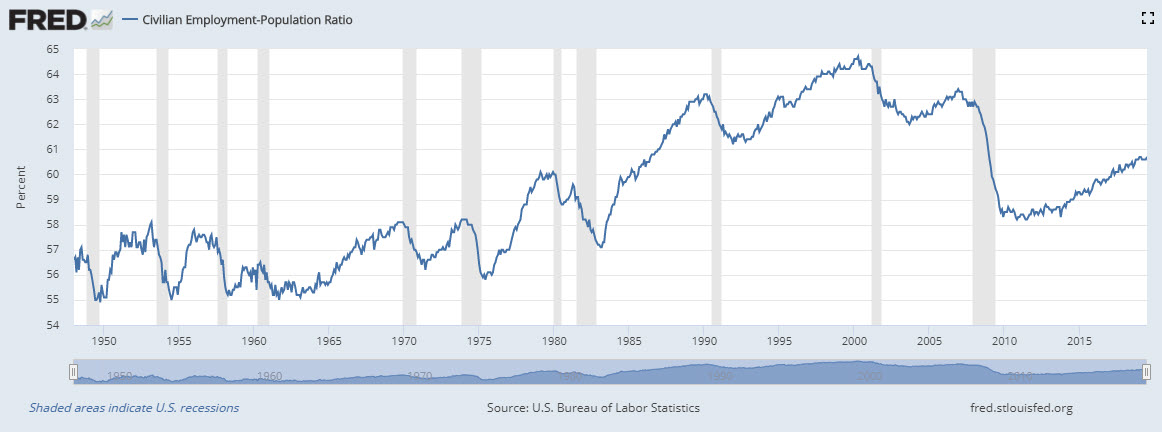

The employment rate of the population stands at 60.6%, down from a high of 64.7% in April of 2000. The post-recession bottom was 58.2% in July of 2011.

chart source: FRED

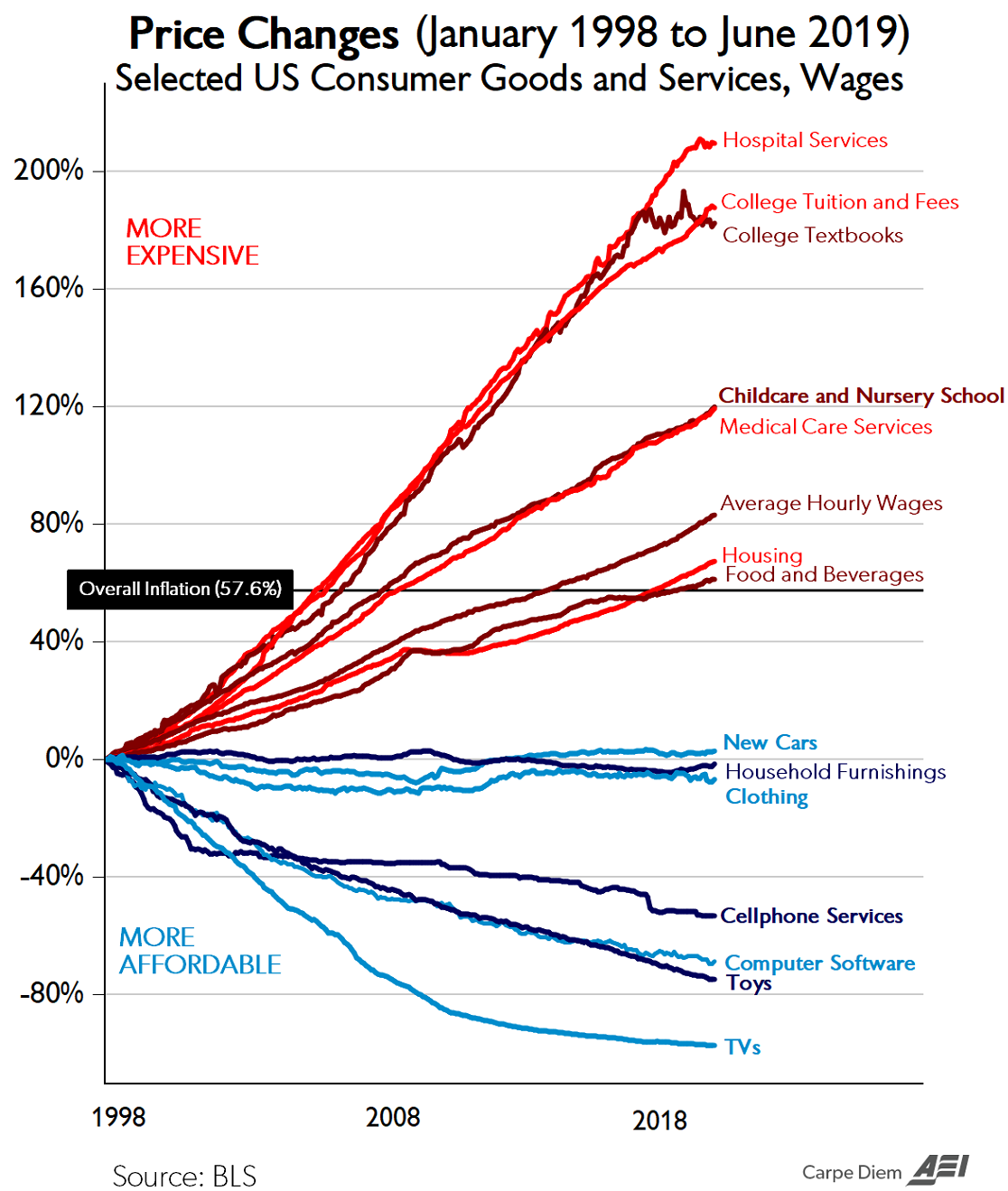

While wages have struggled to keep up with inflation, the essential costs of living like education & healthcare have grown rapidly.

chart source: AEI's Carpe Diem, based on BLS data

"There's class warfare, all right, but it's my class, the rich class, that's making war, and we're winning." is a famous Warren Buffett quote which Ben Stein shared on November 26, 2016 in the New York Times.

Mr. Buffett compiled a data sheet of the men and women who work in his office. He had each of them make a fraction; the numerator was how much they paid in federal income tax and in payroll taxes for Social Security and Medicare, and the denominator was their taxable income. The people in his office were mostly secretaries and clerks, though not all.It turned out that Mr. Buffett, with immense income from dividends and capital gains, paid far, far less as a fraction of his income than the secretaries or the clerks or anyone else in his office.

The trend of increasing income inequality has been in place since the 1970s. Since Warren Buffett shared his famous quote income inequality has become even more pronounced with wealth inequality reaching levels last seen in the Roaring Twenties. Donald Trump signed the Tax Cuts and Jobs Act in 2017, which primarily benefited corporations & the top 10% of income earners.

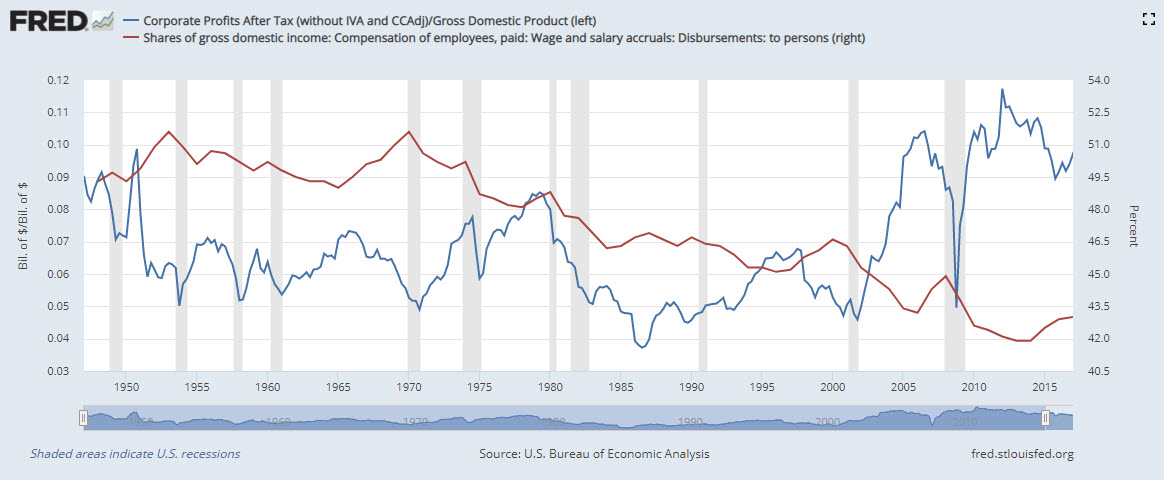

graph source: FRED

Corporate profits have soared but wages as a share of GDP have only recovered about half their losses since the recession.

Increasing market concentration has diminished the share of profits which go to labor & threatens the economy:

If companies know they must create moats to attract investors, they will use political power to raise barriers to new entrants or acquire patent protections, building the walls ever higher. Failing that, they’ll just buy out the competition. Tepper notes that Google, Facebook, Amazon, Apple, and Microsoft have purchased 436 companies and startups in the past ten years, without a single regulatory challenge to any acquisition.

In spite of great productivity gains offered by the Internet, entrepreneurship has fallen in recent decades. Some of the strongest platform companies have earned stock market acronyms like FANG & are seen as the true American Gods:

Our new gods – our American Gods – are the only thing left worthy of our love and attention in the current moment. And the Saints who guide us – Dimon, Zuckerberg, Cook, Fink, Page, Bezos, Musk, Bogle – have shown themselves to be far more worthy of investor adulation than Congress or the White House. For the 20% of Americans who own 80% of America’s wealth, these companies are the objects of worship.

Some people afraid of a future where their prospects were uncertain felt they had no choice but to own the robots:

A 45 year old married father of two with a mortgage and a pair of college educations to fund. The remote yet persistent threat of a nuclear war is not what keeps him up at night. In fact, he might almost see it as a relief should it come. He is a bundle of raw nerves, and each day brings even more dread and foreboding than the day before. What’s frying his nerves and impinging on his amygdala all day long is something far scarier, after all. He, like everyone else, is afraid that he doesn’t have a future.He is petrified by the idea that the skills he’s managed to build throughout the course of his life are already obsolete. ...

It’s thrilling to be a part of if you’re an owner of the robots, the software and the automation. If you’re a part of the capital side of that equation.

If you’re on the other side, however – the losing side – it’s a horror movie in slow motion.

The only way out? Invest in your own destruction. In this context, the FANG stocks are not a gimmick or a fad, they’re a f***ing life raft.

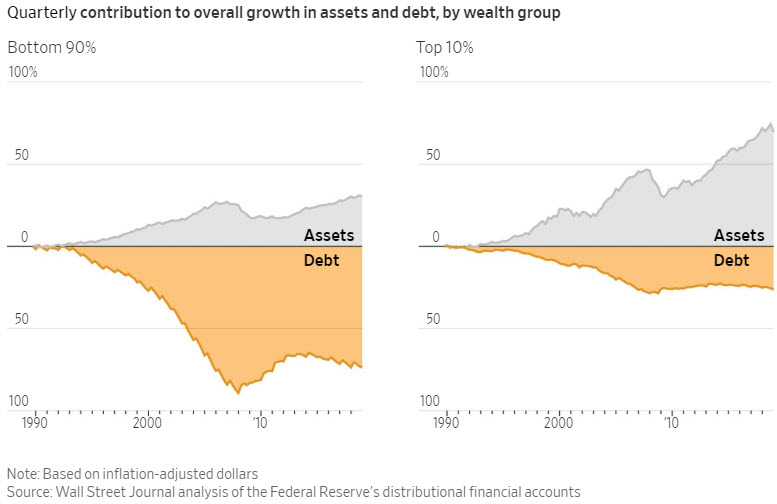

The bottom 90% of the population have built up debt while the top 10% of the population have seen their asset values grow.

Source: WSJ: Families Go Deep in Debt to Stay in the Middle Class, August 1, 2019.

Gallup polls show Americans between the age of 18 to 29 now view socialism more favorably than capitalism.

As the recovery passed by younger people their faith in capitalism has declined.

| Year | Positive view of capitalism | Positive view of socialism |

|---|---|---|

| 2010 | 68% | 51% |

| 2012 | 56% | 49% |

| 2016 | 57% | 55% |

| 2018 | 45% | 51% |

People aged 65+, who benefited from inflating financial asset prices, still have far more faith in capitalism.

| Year | Positive view of capitalism | Positive view of socialism |

|---|---|---|

| 2010 | 54% | 30% |

| 2012 | 57% | 26% |

| 2016 | 63% | 24% |

| 2018 | 60% | 28% |

Perspective on the economy & faith in institutions are driven by much more than the price of avocados.

Real Estate Buyers: Are You Unsure Which Loans You'll Qualify For?

We have partnered with Mortgage Research Center to help local homebuyers and refinancers find out what loan programs they are qualified for and connect them with local lenders offering competitive interest rates.